Union Budget 2025-26 Latest News in Hindi: Finance Minister Nirmala Sitharaman has given a big relief to the middle class. Now income up to Rs 12 lakh will be out of the scope of income tax. Know about the Finance Minister’s announcements on income tax here.

Budget on Income Tax: Finance Minister Nirmala Sitharaman has given a big relief to the middle class. Now income up to Rs 12 lakh will be out of the scope of income tax. The Finance Minister said in the budget on direct tax that the spirit of justice will be given priority in the new Income Tax Bill.

Up to how much taxable income will not be taxed now?

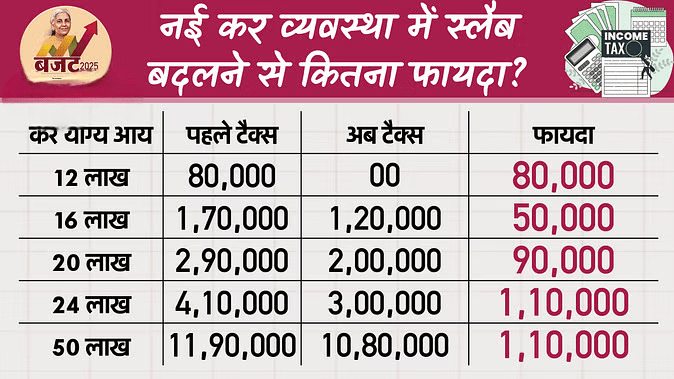

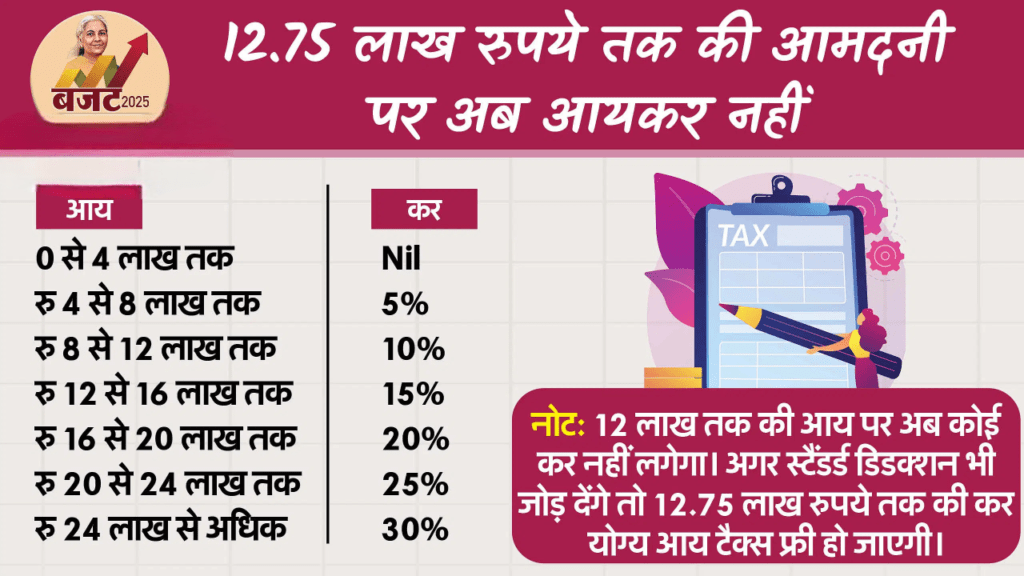

The Finance Minister said that there will be no income tax on income up to Rs 12 lakh. When standard deduction is also added to this, there will be no tax on taxable income of Rs 12.75 lakh for salaried people. The Finance Minister has said that this decision will help in reducing taxes on the middle class to a great extent. They will have the opportunity to leave more money, increase domestic consumption, savings and investment.

The Finance Minister has announced that changes are being made in the income tax slabs and rates to benefit all taxpayers. The Finance Minister has said that under the new tax system, there will be zero income tax up to an income of Rs 12 lakh. The government has paid special attention to the middle class and improved the personal income tax system.

What did the Finance Minister announce on TDS?

The Finance Minister has said in his budget speech that changes will be made in the TDS limit so that uniformity can be brought in it. The limit of exemption in TDS for senior citizens will be increased from Rs 50 thousand to Rs one lakh. The limit of exemption in TDS on income from rent will be increased to six lakh rupees. According to the Finance Minister, the provisions of higher TDS will remain applicable in non-PAN cases. The limit for filing updated returns has been increased from two years to four years.

What benefit do the elderly get in the case of TDS?

What did they get?

Tax exemption on interest

Who got it?

How much benefit to senior citizens?

Earlier, senior citizens were not required to pay TDS on interest income up to Rs 50,000.

Now, TDS will not be levied on interest up to Rs 1 lakh.

What are the updates related to TDS on rent?

What did you get?

Earlier, TDS was not levied on income up to Rs 2.4 lakh from rent.

Now, TDS will not be levied on income up to Rs 6 lakh from rent.

Who will benefit?

Small taxpayers, who receive rent income in small installments.

How much income was tax free before the budget?

According to the Finance Minister’s Budget 2024, earlier if the annual income of a taxpayer was Rs 7 lakh 75 thousand, then after deducting the standard deduction of Rs 75,000, his income became Rs 7 lakh annually. In such a situation, he did not have to pay any tax. This means that if a person’s monthly salary was around Rs 64000 or Rs 64500, then his income was tax free under the new tax system.

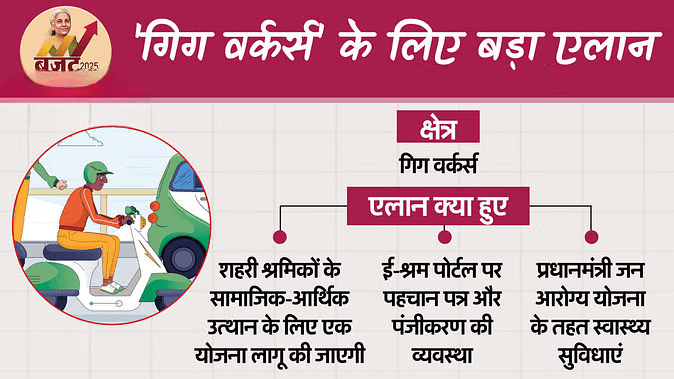

Budget 2025: One crore ‘gig workers’ will be registered on e-shram portal; Government’s big announcement for the poor in the budget

Nirmala Sitharaman said, ‘Gig workers’ of online platforms provide a lot of dynamism to the new age service economy. Respecting their contribution, our government will arrange for their identity card and registration on the e-shram portal.’

The central government has made a big announcement for the poor people in the budget. Finance Minister Nirmala Sitharaman said on Saturday January 1, 2025 that the government will start the registration system on the e-shram platform to help one crore ‘gig workers’. For this, arrangements will also be made for the identity cards of the workers. Employees providing delivery services for e-commerce companies come under the category of gig workers.

Provision of identity card and registration

Presenting the Union Budget 2025-26, the Finance Minister said that a scheme would be implemented for the socio-economic upliftment of urban workers. He said, ‘Gig workers’ of online platforms provide great dynamism to the new age service economy. Honoring their contribution, our government will make arrangements for their identity card and registration on the e-shram portal.

One crore workers likely to get assistance

Sitharaman said that such workers will be provided health care facilities under the Pradhan Mantri Jan Arogya Yojana (PM-JAY). About one crore workers are likely to get assistance from this.

Setting up of ‘daycare’ cancer centres

The Finance Minister said in his budget speech that 10,000 seats will be added in medical colleges and hospitals by next year, while another 75,000 seats will be added in the next five years. The government will also facilitate setting up of ‘daycare’ cancer centres in all district hospitals in the next three years.

Budget 2025-26, FM Nirmala Sitharaman Speech Live Updates: Finance Minister Nirmala Sitharaman is presenting the record eighth consecutive budget today. In the budget, the Finance Minister has made many important announcements for farmers and the MSME sector. The Finance Minister has announced many important schemes for Bihar from her kitty. An announcement has also been made to form a Makhana Board in Bihar.

Live Budget Speech Live: Finance Minister opened the box of schemes for Bihar, many announcements for MSME too

Business Desk, Amar Ujala, New Delhi Published by: Abhishek Dixit Updated Sat, 01 Feb 2025 12:09 PM IST

Special Points

Budget 2025-26, FM Nirmala Sitharaman Speech Live Updates: Finance Minister Nirmala Sitharaman is presenting the record eighth consecutive budget today. In the budget, the Finance Minister has made many important announcements for farmers and the MSME sector. The Finance Minister has announced many important schemes for Bihar from her box. An announcement has also been made to form a Makhana Board in Bihar.

Union Budget 2025-26 Live FM Nirmala Sitharaman Speech Parliament Budget Session Income Tax Slab News in hindi

Union budget 2025 – Photo: Amar Ujala

Reactions

Live Update

12:08 PM, 01-Feb-2025

TDS exemption for senior citizens

Direct Tax

The spirit of justice will be given prominence in the new Income Tax Bill.

Simplification of TDS-TCS

Changes will be made in the TDS limit to bring uniformity in it. The limit of exemption in TDS for senior citizens will be increased from 50 thousand to one lakh rupees. The limit of exemption in TDS on rental income will be increased to six lakh rupees.

Provisions of higher TDS will remain applicable in non-PAN cases. The limit for filing updated returns is being increased from two years to four years.

12:00 PM, 01-Feb-2025

Budget 2025: Complete exemption from basic customs duty to 36 life-saving medicines

It has been announced to give complete exemption from basic customs duty to 36 life-saving medicines. 6 life-saving medicines have been included in the list of 5 percent attractive concessional customs duty. Along with this, 37 other medicines and 13 patient assistance programs have also been completely excluded from basic customs duty.

Provisions to increase exports

Many provisions have also been made in the budget to increase exports. In this, the time limit for handicraft export products has been increased from six months to one year. Even after this, it can be extended for another three months. BCD has also been exempted in wet blue leather. BCD (basic customs duty) on manufacturing and export of frozen fish paste has been reduced from 30 percent to 5 percent.

11:55 AM, 01-Feb-2025

India Budget: Announcement for important minerals

The Finance Minister said that exemption was given in the last budget in important minerals, which are not available in the country. Now I announce complete exemption on waste of cobalt powder and important minerals like lithium ion battery, mercury, zinc etc. This will benefit manufacturing in the country.

Shipping

The Finance Minister said that I continue to propose to continue exemption on raw material components in shipping for the next 10 years. I also make a provision to give exemption for dismantling old ships and making them more competitive.

11:51 AM, 01-Feb-2025

Union Budget 2025: New Income Tax Law will come

A new Income Tax Law will be introduced next week. In the case of income tax, emphasis will be given on trust first, then investigate. Foreign direct investment in the insurance sector will be increased from 74% to 100%. This will ensure that the entire premium amount received by insurance companies from customers is invested in India itself. Under the Jan Vishwas Bill 2.0, more than 100 provisions will be removed from the scope of crime.

11:45 AM, 01-Feb-2025

Budget 2025: Greenfield airports will be developed in Bihar

Greenfield airports will be developed in Bihar. Patna airport will be expanded. The Western Koshi Canal Project will be started in Mithilaanchal of Bihar. An area of 50 thousand hectares will come under its purview.

The top 50 tourist destinations of the country will be developed in collaboration with the states. Employment based development will be promoted. Mudra loan will be given for home stay.

11:40 AM, 01-Feb-2025

Budget 2025: New scheme announced for SC-ST women entrepreneurs

A new scheme will be launched for SC, ST women entrepreneurs, which will have a term loan of up to Rs 2 crore in the next five years.

Investment

A budgetary provision of Rs 1.5 lakh crore is being given to the states for reforms. This will help in increasing the infrastructure. This allocation will be made interest free to the states. Investment promotion mission will be started.

Drinking water has been provided to the rural population of 15 crore through Jal Jeevan Mission.

Urban Challenge Fund will be created

An Urban Challenge Fund will be created with Rs 1 lakh crore. This fund can be used to improve the systems in the cities.

Energy sector

Interstate transmission capacities will be improved. A target has been set to develop 100 GW of nuclear power capacity by 2047.

Udaan

1.5 crore passengers have benefited from the air travel scheme Udaan. 88 airports are connected to it. Under the new Udaan scheme, emphasis will be laid on increasing connectivity to 120 new places and helping four crore passengers in the next 10 years.

11:37 AM, 01-Feb-2025

India Budget: Focus Product Scheme will be launched for footwear and leather sectors

Focus Product Scheme will be launched for footwear and leather sectors. To increase the productivity, quality and competitiveness of India’s footwear and leather sector, support will be provided to machinery for the production of non-leather quality footwear, design capability, things used in manufacturing. Leather footwear and leather products will also be supported.

11:31 AM, 01-Feb-2025

An institute of excellence will be established for the education of artificial intelligence. 10 thousand additional seats will be increased in medical colleges. Day care cancer centers will be set up in all district hospitals. 200 such centers will be built in 2025-26.

Scheme for online platform workers too

The government will help in making their identity cards and provide them e-shram cards. This will benefit 1 crore Gig workers.

11:29 AM, 01-Feb-2025

Budget 2025-26: 50 thousand labs will be set up to promote innovation through Atal Tinkering Lab

Under Saksham Anganwadi and Poshan 2.0, eight crore children, one crore pregnant women and 20 lakh adolescent girls will benefit from this.

Atal Tinkering Lab

50 thousand such labs will be set up to promote innovation in government schools. Bharatiya Bhasha Pustaka Yojana will be started to promote teaching in Indian languages.

National Institute of Excellence for Skilling

Five such institutes will be established. This will be under the objective of Make for India, Make for the World.

Capacity development in IITs, IIT Patna to benefit

In the last 10 years, the number of students studying in IITs will increase from 65 thousand to 1.3 lakh. Help will be given to admit 6500 more students and build their hostels. Infrastructure will be expanded in five IITs including IIT Patna.

11:28 AM, 01-Feb-2025

Budget 2025: National Food Technology Institute to be set up in Bihar

Footwear and leather industries will be promoted. It is expected to provide employment to 22 lakh people. A plan will be implemented to make India a global hub of toys.

National Manufacturing Mission will be launched. In this, emphasis will be laid on clean tech manufacturing.

New institute in Bihar

National Institute of Food Technology, Entrepreneurship and Management will be set up in Bihar. This will help in strengthening food processing capabilities in the entire eastern region. It will increase the income of farmers by increasing the quality of their produce. It will also create opportunities for the youth to acquire skills, entrepreneurship and employment.

11:19 AM, 01-Feb-2025

Budget 2025: Credit cover will be increased in MSME sector

MSME sector

The number of micro, small and medium enterprises is one crore and 5.7 crore people are associated with them. This is helpful in making India a manufacturing hub in the world. These MSMEs account for 45 percent of exports. Credit guarantee cover for MSME will be increased. The investment limit for MSME classification will be increased by 2.5 times. The turnover limit for classification will be doubled

Customized credit

Customized credit will be issued for micro enterprises, the limit of which will be Rs 5 lakh. 10 lakh such cards will be issued in the first year.

Term loan

First-time entrepreneurs will be given a term loan of Rs 2 crore. Five lakh women and Scheduled Caste-Tribe category will come under its purview.

11:11 AM, 01-Feb-2025

Union Budget 2025: Finance Minister made these announcements in the budget speech

- Vegetables, Fruits and Nutrition

The government is promoting the production of vegetables, fruits and grains, along with increasing the income level for vegetables and fruits. For this, the participation of farmer producer organizations and cooperatives will be ensured. Also, plans will be made in collaboration with the state governments. - Makhana Board in Bihar

This is a special opportunity for the people of Bihar so that they can promote the production and processing of Makhana. Makhana Board will help the farmers in this. It will provide guidance and training to the farmers. Cotton Mission is being started for the farmers growing cotton. This will promote longer fiber varieties of cotton. This will help in increasing the income of the farmers.

For self-sufficiency in urea production, production has been started in the urea plant in Assam. A plant with a capacity of 12.78 lakh metric tonnes will be set up in it. National High Yield Seed Mission will be implemented. The services of India Post Payment Bank will be expanded in the rural area. Public sector banks will develop the Rural Credit Score framework for supplying loans to self-help group members and people in rural areas.

11:05 AM, 01-Feb-2025

Budget 2025: ‘This budget will accelerate development’

Finance Minister Nirmala Sitharaman said that this budget is part of the efforts to accelerate development, overall development, increase investment in the private sector, strengthen domestic sensibilities and increase the spending capacity of the middle class. Budget 2025-26 is based on the points of increasing the pace of development, overall development, to promote investment in the private sector, to strengthen domestic sensibilities, to increase the spending capacity of the middle class.

The development measures proposed in the budget cover 10 sectors keeping in mind the poor, youth, farmers and women. These will focus on accelerating agricultural growth and productivity, building rural prosperity and adaptation, taking everyone along on the path of inclusive progress, increasing manufacturing in India and taking Make in India forward, helping MSMEs, enabling employment and growth, investing in people-economy and innovation, ensuring energy supplies, promoting exports and nurturing innovation.

Agriculture

The Finance Minister said that under the Pradhan Mantri Dhan-Dhanya Krishi Yojana, 100 such districts will be selected where agricultural productivity is low. This will help in increasing productivity there, diversifying farming, strengthening irrigation and post-harvest storage capacity. 1.7 crore farmers will benefit from this scheme. All types of farmers will come under its purview. Emphasis will be laid on adopting good methods of agriculture. This will create enough opportunities in rural areas so that migration becomes an option, not a necessity.

7.7 crore farmers of the country will be given the facility of Kisan Credit Card. These will also include fishermen and dairy farmers. The loan limit will also be increased from Rs 3 lakh to Rs 5 lakh.

Self-reliance in pulses

For this, the focus will be on the production of edible oils. The government will launch a six-year mission to achieve self-sufficiency in pulses. Under the six-year mission focused specifically on tur, urad and lentil, the government will buy maximum of these three pulses. NAFED and NCCF will buy three types of pulses. These pulses will be purchased from farmers registered in these agencies.

11:01 AM, 01-Feb-2025

Union Budget 2025: Parliament proceedings begin

Parliament proceedings have started and the Finance Minister has started reading the budget speech. At the same time, the opposition has started a ruckus over the Kumbh incident and opposition MPs are raising slogans.

10:57 AM, 01-Feb-2025

Budget 2025: ‘We don’t have much expectations from the budget’ – Congress leader Jairam Ramesh

Congress leader Jairam Ramesh said on Budget 2025, ‘Intention and content are seen in the budget. Intention and content set the limit. We don’t have much expectations. The steps to be taken, the incentives needed for private investment, I do not expect any such big bang in the budget. But let’s see what will happen for the middle class, will there be tax exemption or not, will we get freedom from tax terrorism? GST needs basic reforms. Modi 3.0 is being discussed but when will GST 2.0 come.’

10:55 AM, 01-Feb-2025

BJP MP Sanjay Jaiswal said about the budget, ‘All the budgets that have come under the leadership of Prime Minister Narendra Modi have given new impetus to development. I have full faith that even today there will be a lot for the poor, women, youth and industries in Nirmala Sitharaman’s budget.

10:57 AM, 01-Feb-2025

Budget 2025: ‘We don’t have much expectations from the budget’ – Congress leader Jairam Ramesh

Congress leader Jairam Ramesh said on Budget 2025, ‘Intention and content are seen in the budget. Intention and content set the limit. We don’t have much expectations. The steps to be taken, the incentives needed for private investment, I do not expect any such big bang in the budget. But let’s see what will happen for the middle class, will there be tax exemption or not, will we get freedom from tax terrorism? GST needs basic reforms. Modi 3.0 is being discussed but when will GST 2.0 come.’

10:55 AM, 01-Feb-2025

BJP MP Sanjay Jaiswal said about the budget, ‘All the budgets that have come under the leadership of Prime Minister Narendra Modi have given new impetus to development. I am confident that even today Nirmala Sitharaman’s budget will have a lot for the poor, women, youth, industries.’

10:49 AM, 01-Feb-2025

Union Budget 2025: Akhilesh Yadav said- The general budget should not disappoint people

Samajwadi Party chief Akhilesh Yadav said, ‘The budget is coming today. The budget should not disappoint the common people. More important than the budget is that even now in Kumbh, people are going to lost and found centers, different places in search of their loved ones. For which Kumbh, no one knows how much budget would have been spent, how many advertisements would be running. The target was to call 40 crore people, there was talk of digital Mahakumbh, CCTV cameras would have been installed, are they not aware of this? Budget is in its place but Kumbh is important. The budget should not disappoint.’

![]()