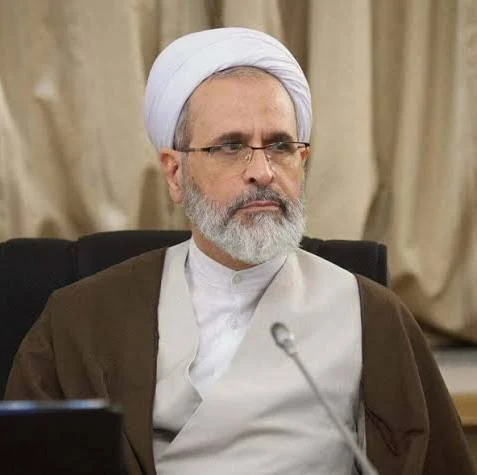

Pakistan Prime Minister Shehbaz Sharif with Crown Prince and Prime Minister of Saudi Arabia Mohammed bin Salman bin Abdulaziz Al Saud. (X.com)

The kingdom has been rolling it over annually without imposing additional costs

Islamabad: Saudi Arabia remains the major source of cheap foreign loans for Pakistan, charging an annual interest rate of only 4 per cent, a media report said on Sunday September 21 , 2025 . Riyadh charged a 4 per cent interest rate on two separate cash deposit facilities obtained by Islamabad in recent years, according to official records. The loan, originally contracted for one year, has yet to be repaid, The Express Tribune reported.

The kingdom has been rolling it over annually without imposing additional costs.

The Saudi loans are about one-third cheaper than Chinese cash deposits and less than half the cost of foreign commercial borrowing, the report added.

A USD 2 billion Saudi cash deposit facility is set to mature in December, and the Ministry of Finance plans to roll it over again, according to the report, which quoted sources as saying.

Another USD 3 billion Saudi loan, obtained to plug the external financing gap under the IMF programme, will mature in June next year.

The IMF has stipulated that Pakistan’s three bilateral creditors, Saudi Arabia, China and the United Arab Emirates, must maintain their cash deposits until the completion of the three-year programme.

Together, these countries have provided USD 12 billion in deposits, forming the bulk of the central bank’s USD 14.3 billion gross foreign exchange reserves, the report said.

IMF programmes are no longer as effective in helping Pakistan as they were in the past. The central bank had to purchase over USD 8 billion from the local market to meet maturing debt obligations, despite the IMF package.

The Finance Ministry is reportedly more dependent on multilateral banks’ credit guarantees to access international markets, as the global lender’s economic “clean bill of health” is no longer sufficient on its own.

Sources said that while Saudi loans carry a 4 per cent interest rate, Pakistan is paying around 6.1 per cent on four cash deposit facilities worth USD 4 billion.

These facilities are priced at the six-month Secured Overnight Financing Rate (SOFR) plus 1.72 per cent, making them significantly more expensive than Saudi deposits. However, the Saudi Oil facility of USD 1.2billion is obtained at a flat 6 per cent interest rate, the report quoted sources as saying.

The Chinese facilities, maturing between March and July next year, are also expected to be rolled over in light of IMF conditions and Pakistan’s low foreign exchange reserves. Among the costliest foreign commercial loans was one from Standard Chartered Bank, which extended USD 400 million for six months at an interest rate of 8.2 per cent in the last fiscal year.

The loan was contracted at the six-month SOFR plus a 3.9 per cent margin, the report said. Likewise, the United Bank Limited arranged a USD 300 million loan for merely 10 months at an interest rate of 12-month SOFR plus 3.5 per cent, which was also equal to a 7.2 per cent interest rate, it added, quoting sources. The UAE had initially given a USD 2 billion loan to Pakistan at an interest rate of 3 per cent, but its last USD 1 billion facility was obtained at 6.5 per cent in 2024 ahead of the IMF deal.

Pakistan also obtained a USD 1 billion loan from the commercial banks for a period of five years at an estimated rate of 7.22 per cent. Over 7.2 per cent rate is paid despite the Asian Development Bank having provided partial guarantees to the foreign lenders, it said, quoting sources.

Pakistan is also availing Chinese commercial loans, which are now converted into Chinese currency from USD. The rates on these Chinese facilities vary. The USD2.1 billion equal Chinese commercial facility is refinanced for a period of three years at roughly 4.5 per cent interest rate, said sources.

Likewise, the USD300 million Bank of China loan is taken for two years at a 6.5 per cent interest rate, and another USD200 million is obtained at a 7.3 per cent interest rate, sources added. A USD 1.3 billion loan from Industrial and Commercial Bank of China was taken at a flat 4.5 per cent interest rate, according to The Express Tribune.

(Source-PTI)

![]()