Mumbai. After the success story of Unified Payments Interface (UPI), the Reserve Bank of India (RBI) has announced a new venture – Unified Lending Interface (ULI) which aims to provide “contactless lending” and will soon be available across the country.

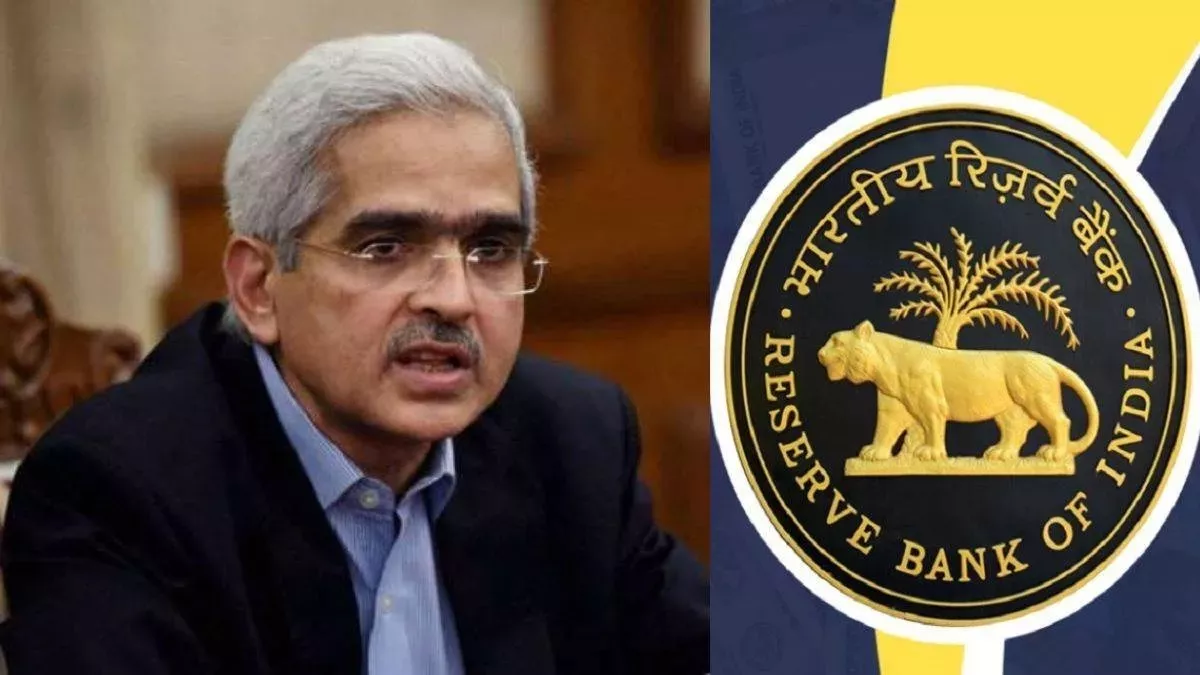

Speaking on this, RBI Governor Shaktikanta Das said that RBI expects ULI to change the lending landscape. “Just as the Unified Payments Interface (UPI) transformed the payments ecosystem, we expect ULI to transform the lending landscape,” Das said at the Global Conference on DPI and Emerging Technologies in Bengaluru on Monday August 26 .

But what exactly is this platform? How will it work? Here we tell you everything we know.

What is RBI’s ULI

On Monday August 26, RBI governor Shaktikanta Das announced that they have decided to name the technology platform they are working on for contactless lending as Unified Lending Interface (ULI).

He said that just as UPI transformed the payments ecosystem, he expects ULI to play a similar role in transforming the lending sector in the country.

But what exactly is this platform? ULI, a digital platform, is expected to ease the lending process. According to the report, ULI will facilitate seamless and consent-based flow of digital information, including land records of various states, from multiple data service providers to lenders.

Currently, the data required for loan appraisal is available with various entities such as the central and state governments, account aggregators, banks, credit information companies and digital identity authorities. However, with the platform, all data will be available in one place.

“By digitising access to financial and non-financial data of customers, which otherwise resided in different silos, ULI is expected to meet the huge unmet demand for credit across various sectors, especially for agriculture and MSME borrowers,” the RBI governor said on Monday August 26 . The governor further said that ULI will reduce the time taken for loan appraisal, especially for small and rural borrowers.

He said the ULI architecture has common and standardised APIs, designed for a “plug and play” approach to ensure digital access to information from various sources. This will reduce project complexity and allow seamless delivery of loans at a faster rate without the need for extensive documentation.

Is ULI already in use?

No. The current ULI is in the pilot phase, and will soon be available for the country. Das said. “The pilot for ULI was launched by the RBI last year to enable frictionless lending. And based on the experience of the pilot, RBI will decide to roll out ULI across the country.”

He said. “Just as UPI transformed the payments ecosystem, we expect ULI to play a similar role in transforming the lending sector in India.”

Das also said in his speech, “The earlier trinity was Jan Dhan-Aadhaar-Mobile (JAM). The new trinity JAM-UPI-ULI will be a revolutionary step in India’s digital infrastructure journey.”

How successful has UPI been?

The ULI program builds on the success of the Unified Payments Interface or UPI. This real-time payment system was launched in India in April 2016 by the National Payments Corporation of India (NPCI).

Since its launch, it has become the preferred channel for digital payments in India; it is used by over 30 crore people and over 5 crore merchants in the country. In August last year, UPI achieved the remarkable milestone of 10 billion transactions. A January report further said that about 118 billion transactions were done through UPI last year. This was a 60 percent jump compared to the 74 billion UPI transactions recorded in 2022.

Another measure of UPI’s success is its availability in foreign countries. Malaysia, France, Nepal, Sri Lanka, Mauritius, Oman and Bhutan accept payments through the UPI app.

As the Centre noted, UPI’s unprecedented adoption and acceptance from humble beginnings in 2016 to today is a unique story, unmatched in terms of its scale and impact.

![]()