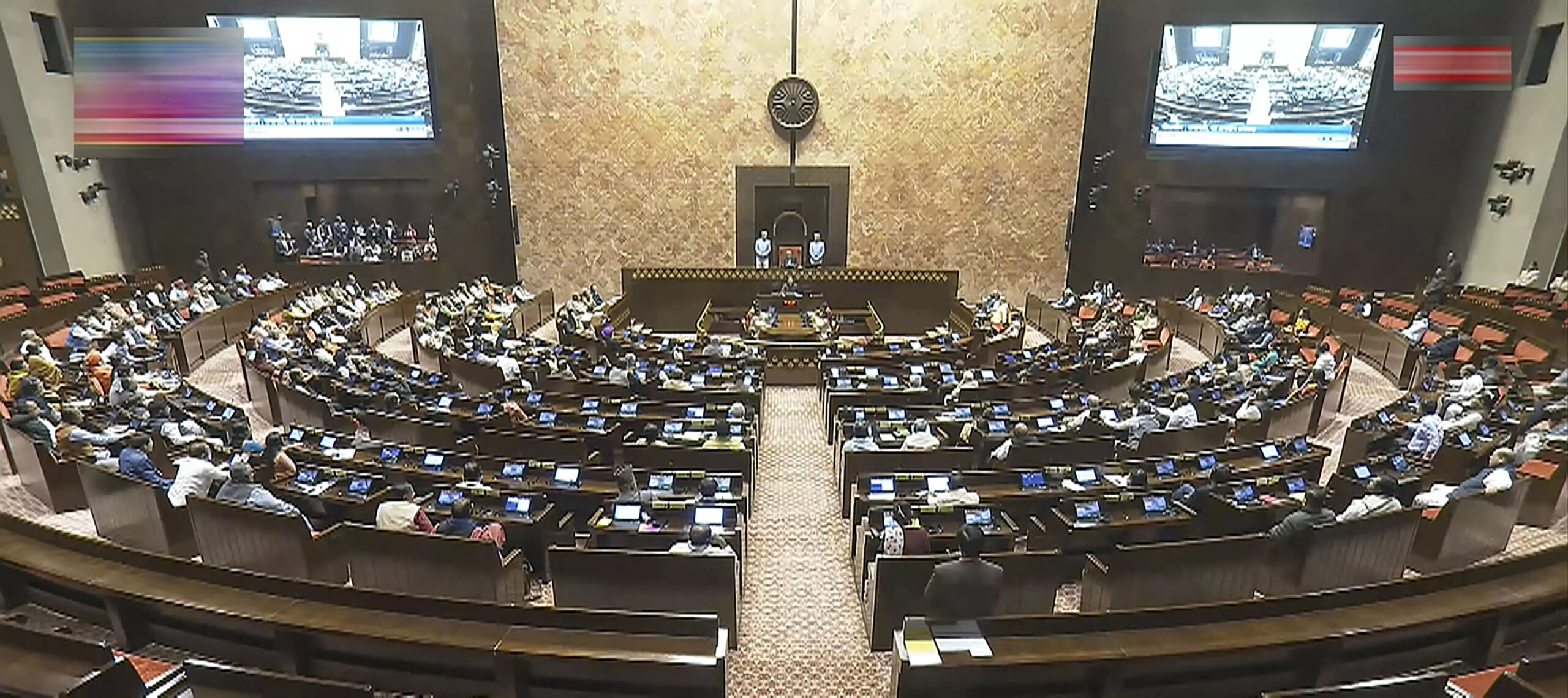

he new legislation, mostly focussing on the direct tax code or DTC, is aimed at revamp the existing income tax structure to simplify the provisions. (Image: PTI)

Govt to introduce a concise Income Tax Bill, reducing complexity and making compliance easier for taxpayers

New Delhi: The new income tax bill, likely to be tabled in Parliament next week, will not have long sentences, provisos and explanations. The new bill, which will replace many old provisions of the six-decade-old income tax law, is likely to be discussed at the Cabinet meeting on Friday, according to a top finance ministry source.

The government is making its all-out effort to bring simplicity to the taxpayers with the new income tax bill and also announced that it will be 50 per cent less in text and clearer compared to the previous one. “The new income tax bill is expected to make compliance of the income tax law easier for taxpayers and income tax authorities by reducing complexity. The bill is part of a broader push to reform the taxation system,” the source said.

The new legislation, mostly focussing on the direct tax code or DTC, is aimed at revamp the existing income tax structure to simplify the provisions. It will replace the existing Income Tax Act, 1961. Sitharaman had said in her budget speech that the bill would embody the same philosophy of Nyaya that was at the heart of Bharatiya Nyaya Sanhita.

The new income tax bill, which will replace the Income Tax Act, 1961, has been drafted within 6 months and efforts have been made to simplify the language to help taxpayers understand. Also, the new law has been made concise, removing old provisions thereby making it less bulky.

The new bill, which was announced by Union finance Minister Nirmala Sitharaman in her Budget speech, will also incorporate the changes made in income tax rates, slabs and in tax deducted at source or TDS provisions made in the Budget for 2025-26

“The new law would be simple. Laws are not supposed to be meant for only legal professionals. It is for citizens to understand,” Pandey said, adding “We are also not changing policy in a big way. We do not want to create any unstable situation.”

( Source : D C )

![]()