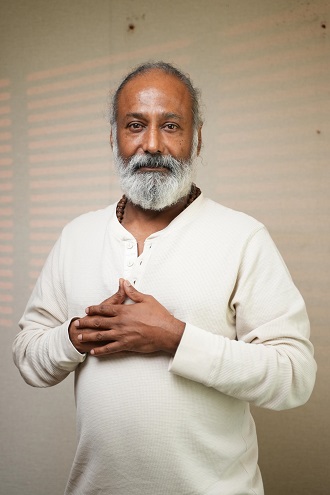

Important decision of GST Council – Photo : ANI

The ST Council has taken an important step to prevent Goods and Services Tax (GST) evasion. Many major decisions were taken in the meeting held yesterday. This also includes approving the proposal to implement a ‘track and trace’ mechanism for some goods suspected of tax evasion. Under this, a specific mark will be put on such goods or packets, so that they can be traced in the supply chain.

What is its purpose?

Its purpose is to include a provision through Section 148A in the Central Goods and Services Tax (CGST) Act, 2017, to empower the government to implement a mechanism to monitor and trace (track and trace) products prone to tax evasion.

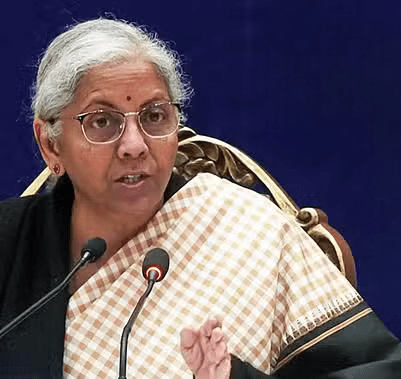

GST Council meeting – Photo: ANI

Know about the system

The Finance Ministry, while explaining the decisions taken in the 55th meeting of the Council, said that this system will be based on a unique identification mark. It will be affixed on the goods or their packets. This will provide a legal framework for developing such a system. Apart from this, it will also help in the implementation of the mechanism for tracing the specified goods in the supply chain.

GST Council meeting – Photo: ANI

What did the Finance Ministry say?

According to the statement issued by the Finance Ministry, ‘It is clarified that in respect of supply of online services like online money gaming, OIDAR services etc. to unregistered recipients, the supplier is required to mandatorily enter the name of the state of the unregistered recipient on the tax invoice and such name of the state of the recipient shall be deemed to be the address recorded in the records of the recipient for the purpose of section 12(2)(B) of the IGST Act, 2017, read with the provision of rule 46(F) of the CGST Rules, 2017.’

GST Council meeting – Photo: ANI

Clarified stand on GST on popcorn

After the GST Council meeting, Finance Minister Nirmala Sitharaman clarified that 12% tax will be levied on pre-packaged and labeled popcorn. If sugar is added to it, then GST will be applicable on it at the rate of 18%. The council will issue a separate circular on its prices. Popcorn will be taxed in three ways as before. The first is those prepared for eating by mixing salt and spices and packed, but there is no label on them. 5% GST will be applicable on such packed popcorn. If the packet is also labeled, then the GST on it will increase to 12%. All these taxes are already applicable, now they have been clarified. The Finance Minister appealed to avoid misinformation in the media and said, all these taxes are already applicable. GST has now clarified them

GST Council meeting – Photo: ANI

Buying an old vehicle will be expensive

If you are interested in buying an old vehicle, then now you will have to pay 18% GST on it. Earlier this rate was 12%. This will be applicable when you are buying from a company. GST will be applicable only on the profit made on purchase and sale. If you are buying from an individual, then no tax will be levied. New electric vehicles will attract 5% GST as before. The GST Council also clarified that if banks or financial institutions impose any penalty on customers who do not follow the terms of the loan, then no GST will be levied on it.

GST Council meeting – Photo: ANI

Also know the important decisions of the meeting

Finance Minister Nirmala Sitharaman said that the Council has decided to reduce the rate on Fortified Rice Kernel (FRK) from 18 percent to five percent. Gene therapy has also been exempted from GST.

The decision to reduce tax on life and health insurance premium, aviation fuel and food delivery platforms will be taken in January.

The Council discussed in detail the imposition of GST on quick commerce, e-commerce and food delivery apps, but did not take any decision.

The decision regarding insurance premium will be taken after talks with the Group of Ministers and insurance regulator IRDAI. IRDAI will have to give its proposal to the Council. All the states could not agree on this.

5% tax on nutritious rice, no fee will be charged on supply of black pepper, raisins from farmers.

Payment aggregators will get tax relief on payments less than Rs 2,000, but this relief will not be available to payment gateways and fintech services.

The GST Council retained the GST exemption being given on defense sector equipment under the 2019 decision

![]()